Sale Document Comments

Adding Comments to Sale Documents

If you have the generic bank details and mail information showing on your invoice, this comment will be above the details.

In the Livestock Module of Stockyard:

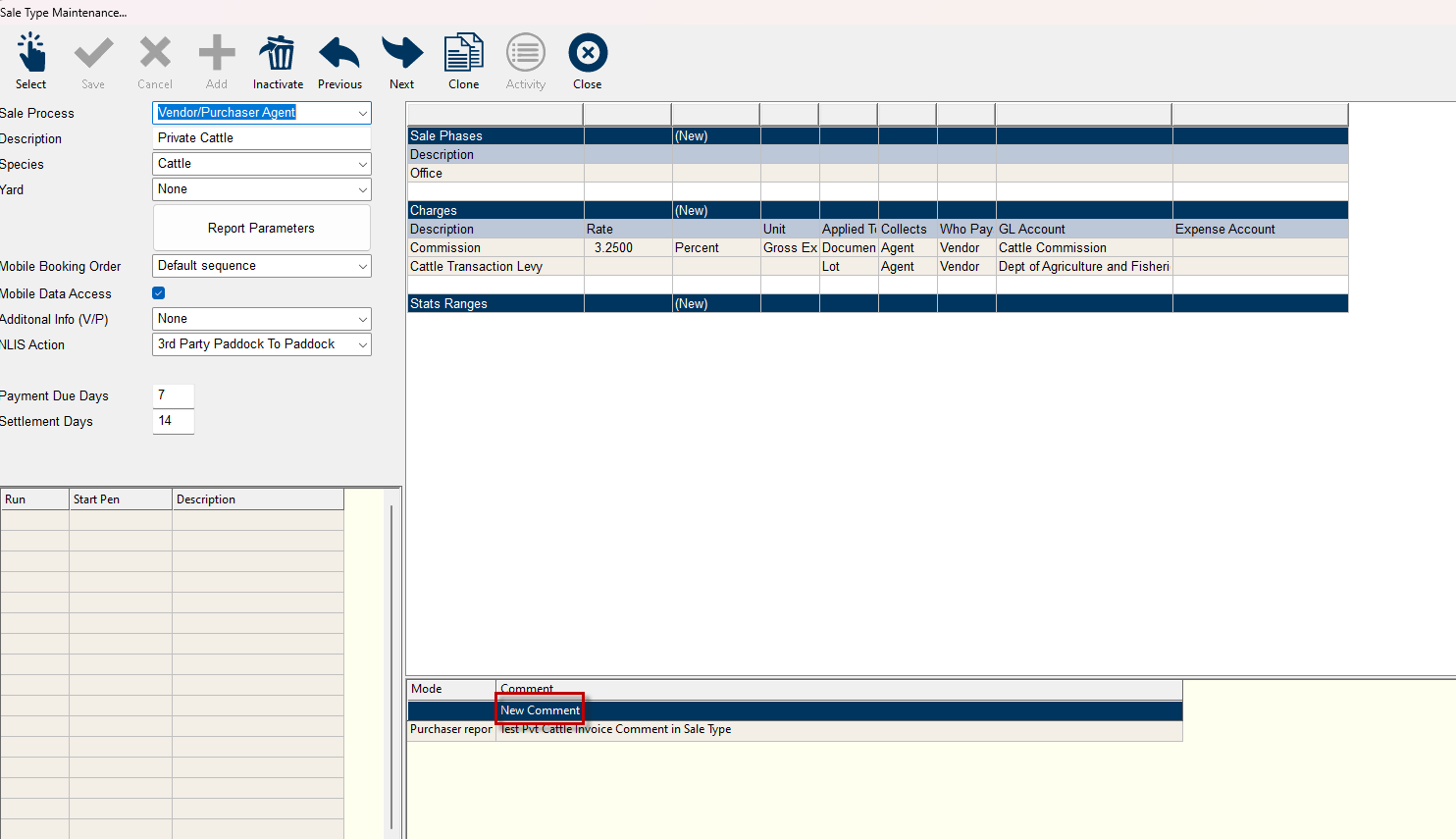

Step 1: Open the Sale Type

- Click on Maintenance > Sale Type or

- Click on the Sale Type button if there is one.

Step 2: Select Sale Type

Step 3: Select New Comment

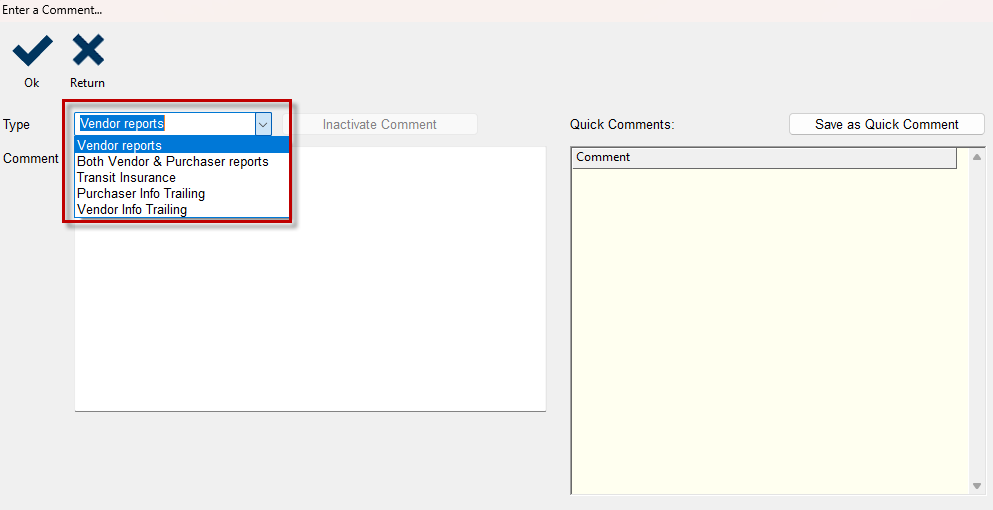

Step 4: Select Report Type

Step 4: Enter Comment Detail

- Enter a couple of blank lines to give some space at the end of the invoice.

- If you would like to attract more attention to the comment you can add some separating lines as below.

- Add the required information

Step 5: Save as Quick Comment for future use in other Sale Types

Step 6: Click on OK

Generate the report to check comment displays as you would like it to.

This will need to be repeated for each Sale Type you would like the comment to appear in.

The saved Quick Comment can be used when updating the other sale types.

To Add Customised Comments for a Sale already generated in Livestock:

- Click on the Sale button to make changes just for this sale, or

- Click on the Sale and Sale Type buttons consecutively to make permanent changes for the sale type so that it appears in all future sales too.

- Click on New Comment

- Enter a few blank lines to separate the new detail from what is already in the invoice.

- Make a dividing line to bring attention to the comment (see below)

- Add the comment e.g. bank details (if you have removed the generic remittance details)

- Save as Quick Comment for future use.

vii. Generate your invoice and check the details

Related Articles

Internal Comments on Livestock Reports

To see how to add visible comments for invoices or account sales, please see Adding Comments to Sale Documents. Internal lot comments can be used when receiving animals to note anything unusual like a missing tag or wellbeing. Saleyards will have a ...Adding Payment Terms on the Tax Invoice

Introduction Starting with version 5.2.0 of Stockyard, we've restructured the way we manage Bank Details for the Company. Previously located under Accounting, this information has now been moved to the Company Proxy in the Main Menu. This adjustment ...Stockyard Beginners Guide - Creating a Sale

Creating and processing a sale in Stockyard is a step-by-step workflow that ensures all sale details — from vendor NVDs and lot creation to purchaser ways and RFID validation — are accurate and complete before reports or settlement are finalised. ...Clearing Sale Overview

The Stockyard Clearing Sale module allows agents to sell items other than livestock in a more basic format. It was created for use out of the office and in an environment where invoices could be printed, payments taken, money banked and sale ...Bidder (Stud) Sale Process

Introduction Creating a Bidder Sale in Stockyard is very similar to running a normal sale (Refer to how to create a sale). The main differences are that a bidder sale introduces: A Bidders button (to register and manage bidders) A Bidders tab (to ...